Like last weekend's thunderstorm that crashed and banged overhead then faded away into the distance, only to return hours later, the IRS tax withholding issue at Zazzle rumbles on!

This is the third month that I've had very little art work in progress to show

because so much of my time has been taken up with trying to make sense of the legalese of tax treaties and IRS instructions, writing emails to Zazzle and generally trying to persuade them to drop the 'burdensome' ITIN (International Tax Identification Number) requirement which they have told us throughout comes from the IRS.

Of course, I haven't by any means been working alone on this.

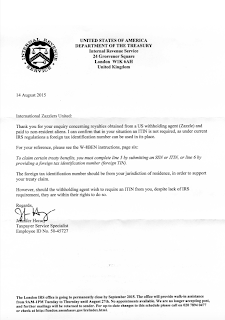

We have more than 200 members in the International Zazzlers United facebook group and by putting our heads together, we have the HMRC Tax Treaty team taking this issue up with their US counterparts and have recently obtained a letter on IRS headed notepaper that states clearly that the IRS do not insist on us getting an ITIN.

We are currently waiting for Zazzle to respond to this, having sent them a copy of the letter last week. (see update below)

In the meantime the group has been helping members get their updated W-BEN forms approved - no simple matter! - so that they can get paid at all! And now we are trying to spread the word to all the international designers/artists who had 30% tax incorrectly withheld from their August earnings, that they can reclaim the money from Zazzle directly and do not have to get it back from the IRS, a process that would require them to get the dreaded ITIN! (Scroll down to Adjustment for Overwithholding.)

But I haven't been totally idle on the art and design front.

I have added a new pattern to my 'Egyptian' collection, the rusty red 'Tribal Shields' pattern on the clock -

And I've made a start on my 2015 Christmas Card, better late than never -

And finally, the Annual Phlox I grew from seed, that tried my patience when I was faced with about 160 tiny seedlings to transplant, is flowering and is begging me to make it into a new floral, cottage-style 'mini-print' pattern that I hope to have at least started by the time I write next month's blog post!

It's definitely feeling as if summer is all but over here; I was tempted to put the heating on first thing this morning. Not that I've had much time to enjoy my little garden this summer - the Great Tax Debacle began in early June!

This is the third month that I've had very little art work in progress to show

because so much of my time has been taken up with trying to make sense of the legalese of tax treaties and IRS instructions, writing emails to Zazzle and generally trying to persuade them to drop the 'burdensome' ITIN (International Tax Identification Number) requirement which they have told us throughout comes from the IRS.

Of course, I haven't by any means been working alone on this.

|

| Click to enlarge |

We have more than 200 members in the International Zazzlers United facebook group and by putting our heads together, we have the HMRC Tax Treaty team taking this issue up with their US counterparts and have recently obtained a letter on IRS headed notepaper that states clearly that the IRS do not insist on us getting an ITIN.

We are currently waiting for Zazzle to respond to this, having sent them a copy of the letter last week. (see update below)

In the meantime the group has been helping members get their updated W-BEN forms approved - no simple matter! - so that they can get paid at all! And now we are trying to spread the word to all the international designers/artists who had 30% tax incorrectly withheld from their August earnings, that they can reclaim the money from Zazzle directly and do not have to get it back from the IRS, a process that would require them to get the dreaded ITIN! (Scroll down to Adjustment for Overwithholding.)

But I haven't been totally idle on the art and design front.

I have added a new pattern to my 'Egyptian' collection, the rusty red 'Tribal Shields' pattern on the clock -

|

| Christmas Mice |

And finally, the Annual Phlox I grew from seed, that tried my patience when I was faced with about 160 tiny seedlings to transplant, is flowering and is begging me to make it into a new floral, cottage-style 'mini-print' pattern that I hope to have at least started by the time I write next month's blog post!

Will it be all over by the time I write my next Work in Progress blog post? The jury's still out on that one but I very much hope so!

Zazzle will continue to accept W-8 forms that are correctly-filled-out, and which do not have a US TIN but do provide a foreign TIN, in order to minimize your withholding tax deductions. We are continuing to ask all non-US resident Designers to submit an updated W-8 form as soon as possible in order to avoid the IRS’s default withholding rate of thirty percent (30%). Please submit your updated W-8 form to Zazzle-w8@zazzle.com as soon as possible.

It’s possible that the requirements may change in the future, so we appreciate your flexibility. Zazzle will continue to support and advocate for our international Designers. We are currently working under the assumption that this temporary resolution will remain valid through 2/28/2017 when the current law is set to expire; however, tax requirements may change at any time due to new or updated tax laws and/or IRS requirements.

Edited at the last minute to say that we've just had this announcement from Zazzle:

We wanted to let everyone know that Zazzle has reached a temporary resolution with the IRS on the US TIN requirement for non-US resident Designers. Based on this new information, a US TIN will not be required on your appropriate W-8 form for the moment. The requirements may change in the future, in the IRS’s sole discretion, as Zazzle is a US-based company that must abide by the requirements of our governing tax authority, the IRS.

Zazzle will continue to accept W-8 forms that are correctly-filled-out, and which do not have a US TIN but do provide a foreign TIN, in order to minimize your withholding tax deductions. We are continuing to ask all non-US resident Designers to submit an updated W-8 form as soon as possible in order to avoid the IRS’s default withholding rate of thirty percent (30%). Please submit your updated W-8 form to Zazzle-w8@zazzle.com as soon as possible.

It’s possible that the requirements may change in the future, so we appreciate your flexibility. Zazzle will continue to support and advocate for our international Designers. We are currently working under the assumption that this temporary resolution will remain valid through 2/28/2017 when the current law is set to expire; however, tax requirements may change at any time due to new or updated tax laws and/or IRS requirements.

There's still the issue of the Refunds to deal with but even so, this is VERY GOOD NEWS!

No comments:

Post a Comment